-

No. 11 Adjuma Crescent, South Industrial Area, Accra

-

info@axoninfosystems.com

-

(+233) 204-330035

(+233) 204-330036

Ghana Revenue Authority

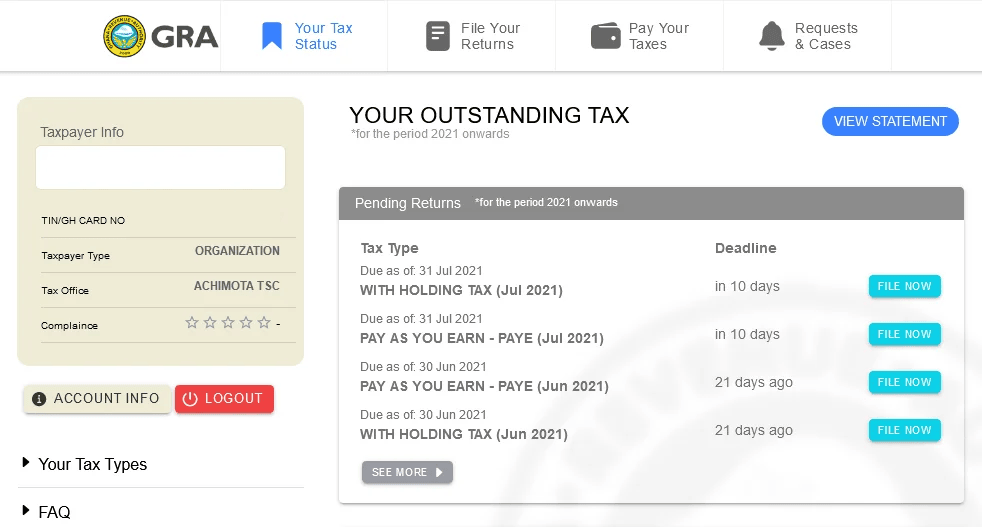

GITMIS 3 is a comprehensive enterprise application that serves as the backbone of tax administration for the Ghana Revenue Authority. A progression from GITMIS 2, this advanced tax information management system was crafted by Axon Information Systems to deliver more than tax data capture – it's a management and decision support system. It leverages the data points captured in the system to deliver crucial insights for decision-making, thereby transforming tax administration.

The GRA's existing tax management process was fraught with challenges. Manual tax filing and processing procedures were time-consuming and prone to errors, leading to delays and inaccuracies. The lack of real-time data access hampered decision-making processes and made it difficult to monitor and enforce tax compliance.

Furthermore, the systems inability to integrate with other governmental systems meant that the GRA was unable to leverage the full potential of data exchange to enhance tax administration. These challenges were impeding the GRA's goal of efficient tax collection and administration, necessitating the implementation of a more robust, integrated tax management system.

Axon Information Systems developed and implemented GITMIS 3, a cutting-edge integrated tax management system tailored to meet the specific needs of the GRA. The system was designed to automate tax filing and processing, provide real-time access to tax data, and integrate with other governmental systems for efficient data exchange.

GITMIS 3 featured an intuitive, user-friendly interface for easy online tax filing, reducing the burden on taxpayers and improving their compliance. It also included an automated tax calculation system, eliminating the possibility of human error and improving accuracy. The real-time reporting feature provided GRA with up-to-the-minute data, enabling quick and informed decision-making.

The implementation of GITMIS 3 began with a thorough analysis of the GRA's existing processes and systems. Axon's team worked closely with GRA staff to understand their specific needs and challenges. The system was then customized to meet these needs and smoothly integrated with the GRA's existing infrastructure, ensuring minimal disruption to ongoing operations.

Extensive training was provided to GRA staff to ensure they were proficient in using the new system. Axon's team also provided continuous support during the transition period, promptly adivressing any issues that arose and ensuring the system was running smoothly and efficiently.

The effectiveness of tax administration is fundamentally linked to compliance – after all, it's a rarity for individuals to willingly approach a tax office to pay tax. This is where GITMIS 3 demonstrates its prowess. The system’s integration capabilities with other monetary and business sectors is instrumental in driving effective monitoring and broadening the tax net. The more GITMIS 3 is integrated with other systems, the better the quality of data it produces for computing compliance, closing tax loopholes and widening the tax net.

A highlight of GITMIS 3 is its interoperability, which, when combined with integration of taxpayers' geographical locations, makes it significantly easier to bring the informal sector into the tax net. Adivressing this challenge has been a longstanding issue in tax administration across many developing nations, and GITMIS 3 brings a much-needed solution.

GITMIS 3 is built on a platform that embodies 12 years of intensive research and development. This solid foundation allows for updates, upgrades, and change requests to be implemented swiftly and efficiently. It's the same robust platform used in the creation of our HealthPro solution, a fully integrated hospital information management system.

GITMIS 3 stands as a testament to Axon Information Systems’ commitment to developing technologically advanced, customised solutions for tax administration. With its diverse functionalities and adaptability, GITMIS 3 not only enhances compliance and expands the tax net, but also facilitates data-driven decision making, all contributing to a more efficient and effective tax administration process. This innovative solution is indeed a game-changer in the realm of tax management.

Enter your email to request for a demo.

We would love to hear from you.