-

No. 11 Adjuma Crescent, South Industrial Area, Accra

-

info@axoninfosystems.com

-

(+233) 204-330035

(+233) 204-330036

Streamline tax with our management solution.

The goal of an Integrated Tax Administration System is to narrow what we call at Axon Information Systems the Creative Gap in Tax Revenue Mobilization. We define Creative Gap in Tax Revenue as the difference between the tax a Revenue Authority collects now and the tax they could have collected. We have identified over the years that technology can be used to increase tax revenue without the need of increasing taxes or introducing new taxes.

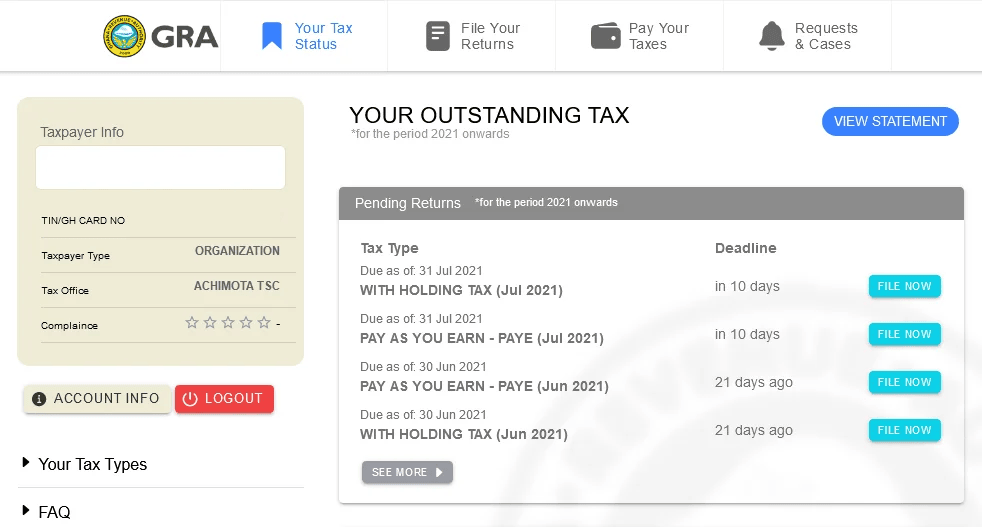

By making tax paying easy for taxpayers and tax administration easy for the tax administrators, tax

compliance will invariably improve as is the experienced of the Ghana Revenue Authority.

Our

Taxpayers Portal Apps allow taxpayers to transact all tax transactions anywhere in the world without

the need to visit the tax office.

The issue of taxpayers failing to declare their income can be reduced markedly using interoperability in Tax Administration System. No efficient tax administrative system operates in isolation. The greater the integration with other relevant systems the better the quality of data for computing compliance, the lesser the tax loopholes and hence the wider and deeper the tax net. Our tax administration systems are designed with the ease of interoperability with other systems as one of its core functions. With interoperability it will be difficult for anyone to remain in the informal sector forever. Once interaction is made with the government sector a component of our tax management system (we call it the Octopus) will make the hit. As it should be in all tax authorities across the world, the country’s Revenue Authority need to know when a Tax Generating Event (TGE) is made and how much is supposed to be paid as tax.

Our eVAT system called VERIS (VAT Electronic Receipting and Invoicing System) is a software approach to VAT fiscalization. VERIS, which has a series of software that takes care of all segments of Value Added Taxpayers, covers eCommerce, Game and Betting Taxes.

As no two tax administration systems of a country operates the same way due to differences in the tax laws, user requirements and business processes of each jurisdiction, we tailor our system to meet the needs on the ground. As experts in test-driven rapid application development, we execute change requests very quickly in a way that is alien to the world of custom software development. This is the result because of 12 years of hard work in developing our software development platform which enables us to effect changes, add new features and modules quickly.

As we always do, we will select the best local partner with extensive experience in implementing systems across the State to work with. In so doing, we will be uniquely positioned to implement a fully integrated tax management system that is fully customized to meet the needs of the country’s Revenue Authority, as well as provide and maintain state-wide support. The ease and speed of executing change requests is key as all institutions evolve with time. Meeting these evolving needs in a prompt manner is one of our specialties.

We do look forward to working with the country’s Revenue Authority to achieve their desired goals in tax revenue mobilization.

Enter your email to request for a demo.

We would love to hear from you.